You can create a reoccurring reimbursement or a one-time reimbursement. Reimbursements do not count as taxable wages.

Create a reoccurring HRA Reimbursement in Poppins Payroll

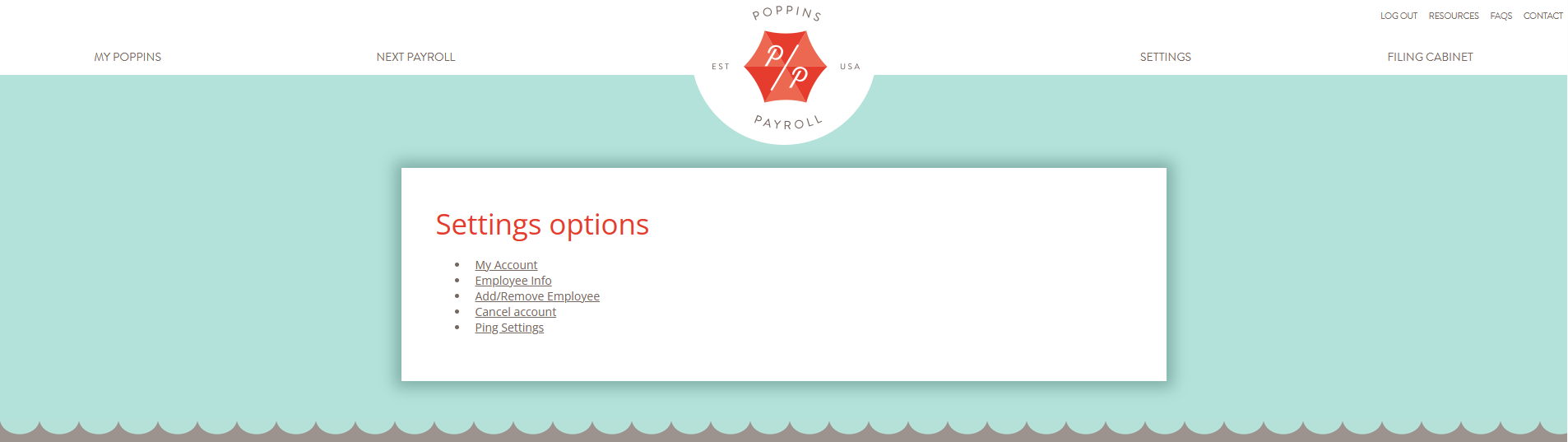

Once you are ready to input your reoccurring reimbursement, login to your Poppins Payroll account. From the homepage, please click on the Settings tab.

From the Settings page, please click the Employee Info option.

On the Employee Info page, please click on the EDIT button listed next to Pay Settings.

On this page, you may enter the reoccurring reimbursement under the Employer Reimbursements box and click the Save & Reset Payroll button when finished. Employer reimbursements will now populate for every pay period regardless of the wage amount.

Note: Once you click the Save & Reset Payroll button, this will reset payroll. We recommend viewing the Next Payroll tab to review your employee's next payroll.

Reimbursement Example: If you have a $300 monthly reimbursement, the math for the below payroll frequencies is as follows:

- Weekly - $300*12/52= Enter $69.23 (rounded) as the reimbursement.

- Bi-Weekly - $300*12/26= Enter $138.46 (rounded) as the reimbursement.

- Semi-Monthly - $300*12/24= Enter $150 as the reimbursement.

- Monthly - $300*12/12= Enter $300 as the reimbursement.

Create a one-time HRA Reimbursement in Poppins Payroll

Once you are ready to input a one-time reimbursement, login to your Poppins Payroll account. From the homepage, please click on the Next Payroll tab.

Once on the Next Payroll tab, you may enter the one-time reimbursement under the Employer Reimbursements box and click the Update button when finished.

Note: This reimbursement will only be applied to the next payroll. This process will have to be repeated for every payroll period a reimbursement is required.

Congratulations, you have now completed your reimbursement!